Ever since the 1800s, Minority Depository Institutions (MDIs) have served as an economic beacon for communities that have been disenfranchised from the traditional banking system.

With a unique understanding of the economic challenges facing this underserved customer segment, MDIs are often a last line of defense for small businesses and households already disadvantaged by the racial wealth divide and struggling to cope with a global pandemic, sluggish wage growth and price inflation.

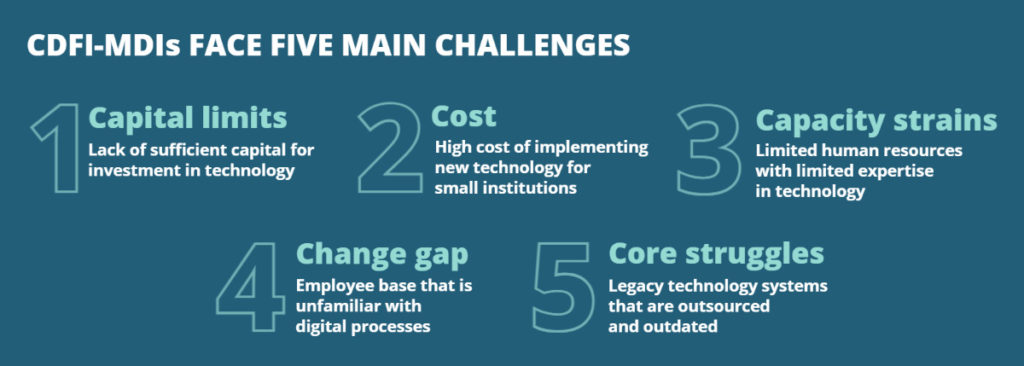

Community banks, credit unions and other financial companies that focus on underserved populations are under constant threat from large competitors and industry consolidation. The most immediate challenge for MDIs to remain competitive is the need to implement costly yet vital technology changes in order to offer the digital financial products that are becoming the industry norm. Without a digital overhaul, MDIs will surely lose relevance or, worse, cease to exist.

To ensure that African-Americans and other minority communities have access to safe and affordable digital financial tools, the Alliance for Innovative Regulation (AIR) is partnering with the National Bankers Association and Inclusiv to launch the MDI ConnectTech Program. The program, funded with support from VISA, will help participating MDI banks and credit unions assess their technology capability, identify upgrades and digital offerings to benefit their customers, and establish a road map to implement third-party digital solutions.

MDIs have served a crucial mission since the aftermath of the Civil War, when emancipated Blacks were excluded from the white-owned banking system. The first MDI, Freedman’s Bank, established a model of financial institutions catering to populations that were kept out of the mainstream economy. Even today, MDIs remain the primary or sole banking option for business owners and consumers who distrust or lack access to mainstream financial institutions.

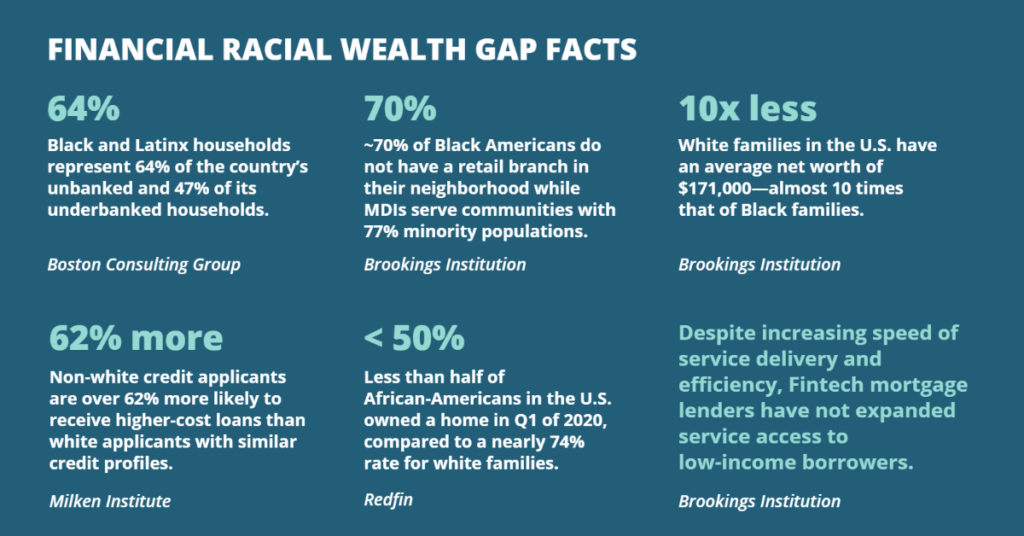

However, as digitization of financial services has exploded over the last decade, MDIs are facing a new challenge over how to remain technologically relevant in the face of competition from larger banks. There is a growing digital divide between financial institutions that can — and those that cannot — afford the cost of digital modernization. This worsens structural barriers to financial services for people of color, exacerbating economic inequalities that have come into greater focus since the 2020 murder of George Floyd.

MDIs are facing an existential dilemma. Without steps to narrow this technology gap, they cannot compete in the digital age. The minority communities that MDIs serve will be at a further economic disadvantage. But most MDIs are still unable to modernize on their own. In many cases, they lack the infrastructure, personnel and technology expertise needed to modernize. In contrast to a larger institution, the expense necessary for an MDI to improve its technology capability relative to its capital and asset size is massive.

The MDI ConnectTech program is intended to provide MDIs with the resources to confront this challenge head-on.

An initial group of MDIs — including banks, credit unions and community development financial institutions (CDFIs) — will pilot a series of deep-dive assessments to better understand their existing techstack, individual goals, strategic priorities and technology gaps. The assessments will help formulate a blueprint for each MDI to implement a third-party digital solution.

The program is meant to start a multi-year “test and learn” collaboration between MDIs, fintech pioneers and technology experts. AIR will release publicly the results of the test as well as a road map to inspire MDIs — and other small financial institutions — across the ecosystem to modernize their digital infrastructure.

The experience of MDIs in the initial group will help create a digital strategy for MDIs on a wider basis to strengthen competitiveness, expand product offerings, improve customer experience, lower costs and improve profitability. The end result will be the preservation of MDIs as a beacon to their customers in the digital age.

Thank you to Visa for providing the inaugural funding that put us on the path to launch MDI ConnectTech.

Click here to stay informed about the latest developments.

WHITE PAPER • A Purposeful Journey into Digitization: Lessons Learned from MDI Digital Modernization Programs

This paper underscores the essential role Minority Depository Institutions (MDIs) play in supporting marginalized communities, while offering a road map for these institutions to remain competitive in the digital financial services landscape.

ARTICLE • The Survival Of Minority Depository Institutions Requires A Journey To Digitization

This brief focusing on key stakeholder actions to support MDIs is a companion to the white paper titled “A Purposeful Journey into Digitization: Lessons Learned from the MDI Digital Modernization Pilot & ConnectTech Programs.”

VIDEO • MDI Innovate: A Purposeful Journey into Digitization Recap

MDI Innovate: A Purposeful Journey into Digitization is AIR’s third convening focused on Minority Depository Institutions (MDIs). This event on May 2, 2024 in Washington, D.C. aimed at addressing the critical issue of digital modernization faced by MDIs.

BLOG • Recapping MDI Innovate: A Purposeful Journey into Digitization

Finding solutions to help minority depository institutions (MDIs) thrive was the central theme of AIR’s high-powered conference, “MDI Innovate: A Purposeful Journey into Digitization,” which took place May 2nd in Washington, D.C.

IN THE NEWS • American Banker Publishes Story on AIR’s MDI Initiative

The Alliance for Innovative Regulation’s effort to highlight technology challenges facing Minority Depository Institutions was the subject of an in-depth article in the industry news publication.

PODCAST • How Minority-Backed Institutions Can Stay Competitive in Digital Age

In this special episode, Jo Ann speaks with three innovators working to help Minority Depository Institutions modernize their technology to continue serving communities of color.

NEWS • AIR Hosts Key Stakeholders at U.S. Capitol to Weigh Future of MDIs

AIR gathered financial policy leaders, bank and credit union representatives, technology innovators and other stakeholders at the U.S. Capitol to advance an ambitious initiative to enable MDIs to adopt the digital tools that they need to improve financial services offerings for communities of color.

PODCAST • Saving Minority Depository Institutions: Nicole Elam and Robert James

Elam and James, who lead the national trade association representing MDIs, come on the show to discuss how these specialized companies are struggling in the face of technological change, competition from larger banks and other forces.

NEWS • AIR Partners with Visa to Help Minority Banks and Credit Unions Close Tech Gap

The MDI Digital Modernization initiative seeks to strengthen competitiveness and customer access at Minority Depository Institutions to narrow the racial wealth gap.

EVENT • Community Banks and Innovation: Helping Small Banks Compete

Community banks are vital to economic wellbeing but are under stress. Challenged to compete with large banks and fintechs, smaller institutions could pioneer focused innovation, but need access to technology to serve customers and cut costs.

VIDEO • The Future of Minority

Depository Institutions: MDI ConnectTech

This in-person event in Washington, D.C. was designed to bring together a diverse community to tackle what’s at stake for bank and credit union MDIs, explore the technological challenges facing these institutions, and to chart a path for how MDIs can thrive in the digital age.

ARTICLE • How MDIs Are Focusing on Technology Needs to Drive Their Mission

Like all small financial providers, Minority Depository Institutions face a challenging environment staying competitive in the digital era. Through a program developed by AIR, the National Bankers Association and Inclusiv, some MDIs are upping their digital game.

EVENT • The Future of Minority

Depository Institutions: MDI ConnectTech

This in-person event in Washington, D.C. is designed to bring together a diverse community to tackle what’s at stake for bank and credit union MDIs, explore the technological challenges facing these institutions, and to chart a path for how MDIs can thrive in the digital age.

WHITE PAPER • AIR Coauthors Paper on MDI Digital Modernization

The article, released with the National Bankers Association and Visa Economic Empowerment Institute, lays out a case for using a shared-technology model to help Minority Depository Institutions (MDIs) enhance digital capability and product offerings.

Stay informed by joining our mailing list