August 28, 2024

Long-time listeners may remember that, when we first launched the Barefoot Innovation podcast show, “fintech” was still a fairly new term. The ranks of fintech firms were pretty small back then, and most of the firms were still little startups. What a difference a decade makes.

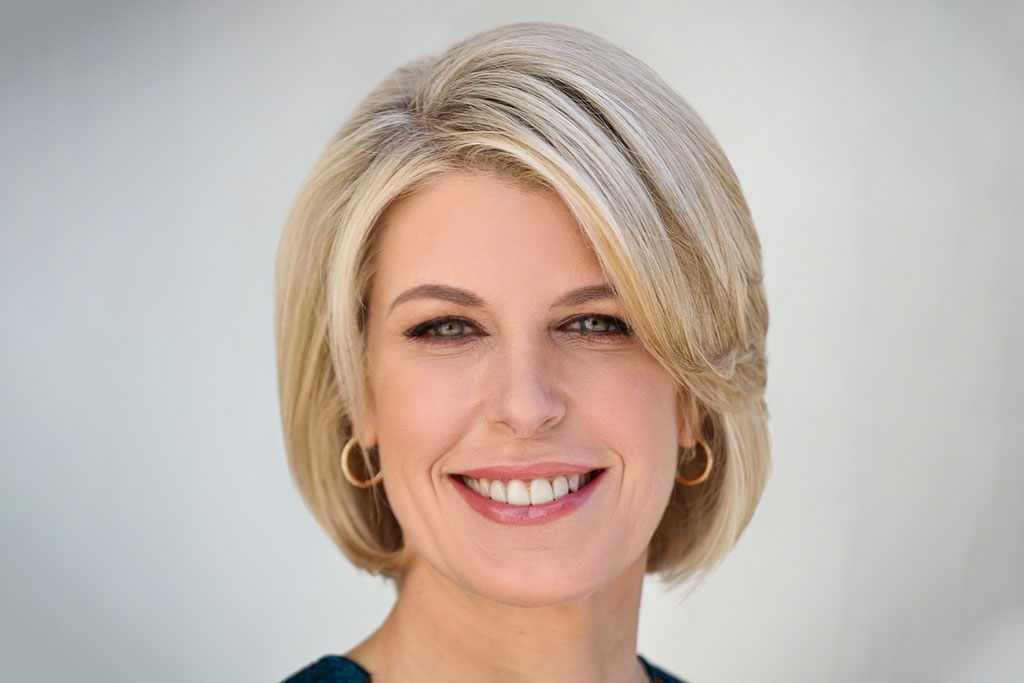

Our guest today is Penny Lee, President and CEO of the Financial Technology Association. The FTA is a trade group representing the fintech industry in the many policy debates underway in Washington D.C. and in state capitals throughout the country.

Penny starts our conversation by talking broadly about how fintechs are trying to change financial services. In most cases, there’s a founding story about someone encountering a problem with traditional finance — which people now sometimes label “trad-fi” — and realizing that new technology could solve it. In the early years, the fintech world talked a lot about “disrupting” the traditional industry and perhaps replacing it. Over the years, however, the disruption game plan evolved. For one thing, the traditional industry began adopting the superior technology that was competing with them. For another, fintechs began working with, rather than against, traditional companies in their sectors. One great lesson of the last decade is that the new companies and the old companies often have very different strengths, and weaknesses, and that many of these are highly complementary. That means that, increasingly, both groups benefit by teaming up.

Penny shares her perspective on these evolving relationships and what the financial market landscape may look like a decade or two from now. She talks about the major challenges facing fintechs today, about new financial solutions like buy now, pay later (BNPL), and about how AI will change the game.

And she talks about the regulatory challenges facing the industry, including the emerging models of how fintechs can work with banks, as vendors, as partners, and as customers. The U.S. has no national-level licensing of non-bank financial firms. Companies like consumer lenders and money transmitters are licensed and supervised by the states, not the federal government. Banks, in contrast, may be chartered at either the state or national level. One result of this structure is that the federal bank regulators oversee fintech activity indirectly, through the banks. As banks and fintechs do more together, the rules and guidelines are evolving, enforcement activity is rising, and novel business models are putting stress on traditional frameworks and processes.

No one knows where all this will take us, but it seems clear that we’ve entered into a period of financial market transformation. Embedded finance is loosening the ties that bind financial providers to their customers. AI is sparking a deep rethinking of whether to push old methods aside and start with new ones grounded in data, new analytics, and generative tools. I think one likely result is that community banks will face existential threats if they can’t keep up with new tech — and keeping pace with new tech will almost certainly require that they increasingly work with fintech firms as partners, vendors and customers. The fintech sector is at the vortex of all of these currents of change.

Let me mention that AIR is doing extensive work on these issues. We have a multi-year project on the future of Minority Depository Institutions (MDIs), and will soon be issuing a white paper on what needs to happen to enable them to survive and thrive. We have also launched an initiative exploring the emerging relationships between banks and fintechs, and are planning a TechSprint on how to address the regulatory concerns that have been emerging in those arrangements. If you would like to get involved in helping, let us know!

Penny Lee is President and CEO of the Financial Technology Association (FTA), a nonprofit organization dedicated to educating consumers, regulators, and policymakers on the value of technology-centered financial services companies. FTA’s member companies are market leaders in the fintech industry, offering innovative financial products and services that serve the broad needs of American businesses and consumers.

Penny has more than 20 years of communications and business experience advising public officials, Fortune 500 companies, enterprising startups, and non-profits with strategic positioning, political strategy, brand identity, and advocacy.

Penny is a co-founder of K Street Capital, an angel investment group. She is an advocate for female and diverse entrepreneurs and serves on the Advisory Board of the Center for American Entrepreneurship. An avid golfer, Lee was the first woman elected President of the Board of Trustees at the Robert Trent Jones Golf Club in Virginia, and she serves on the Board of the National Links Trust, an organization dedicated to increasing access to the game of golf. She also is Chair of the 2024 Solheim Cup, the preeminent event in women’s golf.

Penny holds a BA with a double major in journalism and political science from Baylor University.

We have wonderful guests coming up. We are going to have Congressman Bill Foster back on the show. He is one of the leading members of the U.S. Congress on technology and fintech, and we’re going to hear his thoughts on the outlook for legislative developments. I’m very excited about an episode we’ve recorded with my colleague Nick Cook about his new AIR whitepaper, A Financial Regulator’s Odyssey — which I predict is going to become must-reading for every regulator. We’ll also have fascinating conversations with Soups Ranjan of Sardine, talking about fraud; with Jane Barratt of MX; and with Google on our second paper with them on Model Risk Management (MRM), focusing this time on AI.

I’m looking forward to seeing listeners when I speak at FinTech South in Atlanta this week, and also to see you in September at FinnovateFall, and of course, at Money 2020.

Please be sure to leave us a five-star rating on your favorite podcast platform so more people can find Barefoot Innovation, and please also find me on social media to continue the conversation!

Stay informed by joining our mailing list