December 14, 2021

This show sets a Barefoot Innovation record -- it’s the first time we’ve had a guest come back for a fourth conversation (you’ll note that I say in the recording that this is his third appearance, but I actually undercounted). We did two shows with Christopher Giancarlo while he was Chairman of the USCommodity Futures Trading Commission, and then another after he returned to the private sector and co-founded the Digital Dollar Project with Daniel Gorfine. We’ll link to all of those in the show notes.

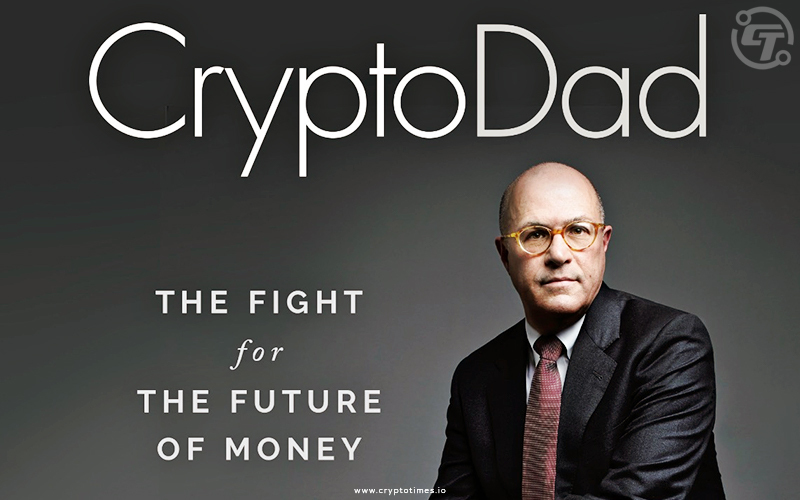

Today, we have Chris back again for something I think you’ll find even more fun and fascinating: to talk about his new book, CryptoDad. Our discussion instantly made it onto my own list of all-time favorites.

Twelve months ago, I started predicting that 2021 would be the year for crypto going mainstream, and I was right. We see huge changes now cascading from these early shifts underway, opening profound challenges to our assumptions about what money is and how we use it. I plan to focus the show heavily next year on crypto, blockchain, defi, the metaverse, and Web 3.0, and my AIR colleagues and I will be delving deeply into them all in our work. My talk today with Chris is a perfect stage setter.

In our conversation, he explains the book’s intriguing title, which was inspired by his experience testifying before the Senate Banking Committee while he was CFTC Chairman. One detail that he omits from his talk with me is that he walked into that hearing room that morning with a few hundred Twitter followers. When he walked back out, he had thousands and, within a few days, tens of thousands. You’ll hear him tell that story, and many others.

One of the delights of this book is that Chris is a wonderful storyteller. We rarely get to listen in on the internal monologue of a US agency head as he or she comes to Washington and learns to navigate the federal government’s corridors of power and and rites and rituals, right down to the political insights revealed by how food is arrayed on buffet tables at fancy receptions. The book is absolutely a page-turner.

It’s also the most reader-friendly account I’ve seen anywhere for people who really want to understand crypto. The world of digital assets has always run on an ethos of the insiders against the world, right down to the mysterious original invention of Bitcoin by the anonymous person or persons called Satoshi Nakamoto. Practitioners delight in making traditionalists scratch their heads at concepts like mining and NFTs and insider terms like FUD and HODL. Even the term “crypto” seems, well, cryptic. Chris has written a book that demystifies it all. Crypto enthusiasts will enjoy its lens on the public policy world, but for those who don’t quite understand crypto and digital assets, Chris offers a wonderful primer.

In our talk today, we survey the landscape. Why is money, itself, changing (again), and how? Why do we regulate banks as unique entities with monopolistic powers -- and what good things might happen if we didn’t have to? What problems can these new forms of money solve? What problems, in turn, will they bring? For example, how are we going to solve the problem of crypto crime and money laundering?

And more questions...What is the Digital Dollar Project doing today, including on pilot tests and privacy principles? More broadly, what will happen with Central Bank Digital Currencies globally? Why and how will CBDC coexist in the market with private cryptocurrencies? What are the risks that CBDC will lead to abusive government surveillance of citizens?, and how might we prevent it? What geopolitical dangers loom? More deeply, how does the advent of defi tie to the vision of America’s founders, who mistrusted concentrated government power and prized economic liberty and privacy?

Chris worries that the US will, in effect, sit out the Web 3.0 revolution, as he believes we did with Web 2.0, 5G, and the Internet of Things (IoT). How should we play this time?

And, not least, for the show’s many regulator-minded listeners, how are we going to regulate all this? I recently explored that question at a Money 2020 session with former acting Comptroller of the Currency Brian Brooks and Hummingbird’s Matt Van Buskirk. (Note that while Chris Giancarlo has written a popular book, Brian Brooks is meanwhile developing a dramatic (but funny) TV series in which the crypto world meets Washington. To paraphrase the old TV ad, this is not your grandfather’s world of financial regulation.)

Let’s ask, should regulators encourage blockchain-based market activity? With defi consisting of blockchains of non-incorporated participants who are self-regulating through open code, will we need to “regulate” them with code? Should regulators, themselves, become nodes on these chains? The changes ahead are breathtaking.

I had a disruptive thought the other day. What if, despite the risk and volatility of crypto markets, they actually do create, quite rapidly, a huge new global community of people who understand the future in a new, tech-native way; who become very wealthy; and who are, disproportionately, young. How might that change the world?

Last summer Chris asked me to write a blurb for the book. Part of what I said was, “Young and old, disruptors and traditionalists, crypto believers and skeptics and the merely curious—everyone will love CryptoDad!” Enjoy reading the whole thing and for today, enjoy my fascinating conversation with Chris Giancarlo!

More on Chris Giancarlo

Dubbed “CryptoDad” for his celebrated call on the US Congress to respect a new generation’s interest in cryptocurrency, the Honorable J. Christopher Giancarlo served as 13th Chairman of the United States Commodity Futures Trading Commission.

Considered one of “the most influential individuals in financial regulation,” Giancarlo also served as a member of the US Financial Stability Oversight Committee, the President’s Working Group on Financial Markets, and the Executive Board of the International Organization of Securities Commissions.

Giancarlo is the author of CryptoDad – The Fight for the Future of Money, an account of his oversight of the world’s first regulated market for Bitcoin derivatives and the coming transformation of financial services, including the most valuable thing of all: money. It was released in October 2021 by John Wiley & Sons.

Giancarlo is Senior Counsel to the international law firm, Willkie Farr & Gallagher. He is also a board director, advisor and angel investor in numerous technology and financial services companies. In addition, Giancarlo is a co-founder of the Digital Dollar Project, a not-for-profit initiative to advance exploration of a US Central Bank Digital Currency. Twitter: GiancarloMKTS

More for our Listeners

2021 is coming to an end and as I reflect back on all of our guests, we have had nothing short of the best! Look out for a 2021 podcast compilation of some of our favorite moments on Barefoot Innovation!

AIR is hosting a webinar on December 13, ‘Into the Cloud: Whether, Why and How

Financial Institutions Are Adopting Cloud Computing.’ Join me and FDIC Chief Innovation Officer Sultan Meghji for a Fireside Chat exploring how agencies are viewing cloud adoption by industry, then hear from a panel of industry participants sharing specific case studies that bring the survey results to life, ranging from retail banking to capital markets to regtech advances.

The 2021 speaking engagements have also come to a close. I am excited to start 2022 off with the ABA Financial Crimes Enforcement Conference, one of my favorites each year. Make sure to register and join me for the closing keynote on January 13.

On the podcast front we have great shows coming up including one with Netherlands’ Queen Maxima, who is the UN Global Advocate for Financial Inclusion and one with the fascinating Hemant Taneja whose book, Unscaled, profoundly changed my thinking a few years back. We’ll also have back my great friend Shamir Karkal, CEO of Sila, with deep insights on the changes ahead.

Don’t forget to follow AIR on LinkedIn and Twitter. Be sure to leave us a five-star rating on your favorite podcast platform. And please follow me personally on Twitter @JoAnnBarefoot.

And as always, keep on innovating!

Stay informed by joining our mailing list