December 23, 2020

This is our final show of 2020 and I predict it will be an all-time favorite. It is already a favorite of mine. That’s because of who my guest is -- Scott Cook, the legendary founder of Intuit -- and also because of what he says. In this conversation, Scott takes us with him in thinking about the roots of innovation, the wellsprings of creativity. Where does innovation come from? How do you turn a good idea into a great company? What values should drive the effort? Scott shares his thinking on all this, he does it mainly by telling us stories drawn from his own experience.

The calamities of 2020 will bring new thinking to every realm of financial services and financial regulation. As we emerge from the wreckage of this terrible year and soon look around and take our bearings, we will find that we’re not back where we were; we will be in a new place. Some of that will be bad, but a lot of it will be good. We’ll find that we have condensed a decade of innovation and technology adoption into just a few short months. For most of it, we will never go back. We will go forward. And we won’t go forward at the speed at which things were changing a year ago. We will be moving faster, and farther, than ever before.

I, for one, have no desire to “go back” to normal. I want 2021 to be better than 2019 was, and better than every year that came before. Precisely because 2020 has broken so much, it has freed us from many old things that needed to change, and it equipped us, rapidly, with both the will and the means to build new solutions.

Intuit was one of the first fintech companies and one of only a handful from that first generation to survive and thrive to this day. It was founded nearly 40 years ago in Palo Alto, California, before we even had the word “fintech.” Scott tells us the story of how he got onto the path of innovation as a young boy (hint -- it has to do with Crest Toothpaste). He tells the story (which I already knew) of how he got the original idea for Intuit’s bill paying tool (before we had the word “app”). He tells the story of market testing his idea by using the simplest, most low-tech process imaginable. He tells the stories of struggling to get their product into stores, and of learning the hard way that they had designed it all wrong, and the harrowing tales of how close them came to failing, and of what it took to succeed anyway. He shares what he learned from it all, in a way that can help the rest of us not repeat his mistakes.

Scott talks about a lifetime of continuous innovation. He shares Intuit’s simple and powerful mission. He talks about the company’s newest business, which has turned out to be its biggest ever and which, maybe counterintuitively, involves adding humans into a tech solution. He shares their experience this year with the pandemic and the SBA’s Paycheck Protection Program, when Intuit dropped everything to get loan guarantees out to the smallest of small businesses. He explains how technology enables the company to serve these tiny enterprises profitably, by having much more information on them than is available to, say, a bank. And, as we enter into a new era of technology change, he shares insights about how technology and humanity will interrelate.

And of course, he has some thoughtful advice for regulators.

There’s a saying that a picture is worth a thousand words. In that same vein, a story can be worth a thousand pages, if the pages are filled with information. Human brains are wired to listen to stories, to wake up and pay attention to them, and to remember them and put them to use. I know I have been remembering Scott’s stories ever since we talked, and have been using them in how I think about the world of change we’ll enter into in 2021.

There is every sign that medical technology innovation will soon be beating back the COVID pandemic. When it does, we will find ourselves still facing all our old problems, combined with a whole set of new ones. We will also find that we have, in our hands, a whole new set of technology tools for solving both.

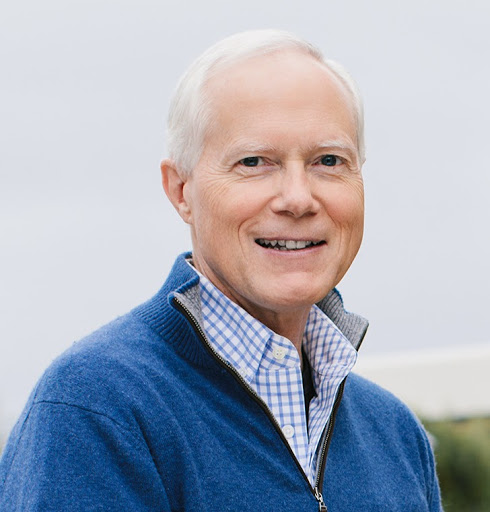

More on Scott

Scott Cook co-founded Intuit Inc. in 1983 and now serves as the chairman of the Executive Committee. Before founding Intuit, Scott managed consulting assignments in banking and technology for Bain & Company, a corporate strategy consulting firm. He previously worked for Procter & Gamble, the household products giant, in various marketing positions, including as a brand manager, for four years.

Scott serves on the boards of directors of Intuit, the Harvard Business School Dean’s Advisory Board, the University of Wisconsin’s Center for Brand and Product Management Advisory Board, the Intuit Scholarship Foundation and the Valhalla Foundation, which accelerates proven interventions in early education and K-12, social development, and medical research.

Scott earned an MBA from Harvard University and received a bachelor’s degree in economics and mathematics from the University of Southern California.

More for our Listeners

Please follow AIR on LinkedIn and Twitter, and also follow me personally on Twitter @JoAnnBarefoot. And be sure to leave us a five-star rating on your favorite podcast platform.

We have great shows lined up for 2021. We’ll have Chris Giancarlo and Daniel Gorfine on the Digital Dollar and Central Bank Digital Currency; Rob Nichols, President and CEO of the American Bankers Association; Nathaniel Harley of MANTL; and Susan French of BBVA Product, among others.

In case you missed it, last week AIR hosted a webinar entitled Community Banks & Innovation — Helping Small Banks Compete in the Digital Age. You can watch the event here. The conversation included acting Comptroller of the Currency Brian Brooks, FDIC Chief of Staff Brandon Milhorn, ABA CEO Rob Nichols, and ICBA CEO Rebeca Romero Rainey, along with leading community bank CEO’s and the core technology firms serving the banking industry.

I also want to share the videos of some of the many of the sessions at which our AIR team spoke this year, as the conference world went virtual. Please enjoy our talks at Lendit Fintech Digital, Global Fintech Festival, Aite Group’s Financial Crime Forum, DC Fintech Week, Central Bank of the Future Conference, Fintech Abu Dhabi, and many more.

I’m excited to announce, also, that I’ll be speaking next year at SouthBySoutwest, on diversifying the world of tech and fintech.

If you didn’t get to reading the Regtech Manifesto that AIR issued in July, I hope you will take a look at it over your holiday break and send us your comments. Feedback is coming in from all over the world and is a primary force shaping out plans for 2021.

As we go into 2021, I wish you a safe and joyful holiday and blessings for the new YEAR.

Stay informed by joining our mailing list