By Shelley Anderson • June 29, 2022

Between April 18-22, AIR — the Alliance for Innovative Regulation was a program partner with India’s Reserve Bank Innovation Hub for the RBIH’s Swanari TechSprint, a virtual tech competition, to develop prototype ideas and foster innovative solutions for creating better digital financial solutions for women. The event brought together tech and financial services providers, startup innovators, and inclusion experts for collaboration and ideation, as well as a lineup of distinguished speakers.

Swanari is short for Swanirbhar Nari, meaning “Self-Reliant Lady” in Hindi. The RBIH’s Swanari program is aimed at closing the financial services gender gap in India. The goal is to help women business owners, single women and women with literacy challenges establish a digital financial footprint and increase their economic and financial resilience and wellbeing. According to an RBIH white paper, women owned only 35.4% of all deposit accounts in scheduled commercial banks (SCBs) in India in 2021. Women’s share of the total deposits as of March 2021 was only 34%. Nearly a billion women worldwide lack access to financial services products. The rise of financial technology presents opportunities in India to address these challenges.

While RBIH, AIR and other program partners are still analyzing findings from the event and solution proposals by the competitors, here are high-level observations.

Competing teams focused on problem statements and use cases along two tracks. In both the “Minimal Viable Product Track” (MVP) and “Ideation and Design Track” (I&D), they were asked to offer solutions for improving digital and financial literacy for certain segments of women using behavior-led design; for helping women frequently save small amounts digitally in Pradhan Mantri Jan-Dhan Yojana accounts (that are tailored for expanding financial inclusion); and for enabling banks to use alternate credit data for women entrepreneurs seeking micro or small-business loans.

From there, the two tracks diverged. The final two use cases in the MVP Track focused on how to increase access to credit products for women-led business enterprises, and how to improve the user experience for women accessing digital financial services. In the I&D track, the final two use cases were focused on how to leverage technology to get more women recruited as Business Correspondents — typically banking agents who assist in account openings in rural areas that lack branches — and how to improve access to institutional and individual investors for women startup founders.

Three teams were recognized for winning solutions in the I&D track, and five teams stood out as winners of the TechSprint in the end.

| Sampatti Card | Builds an income & documentation record for domestic workers enabling access to government & private services |

| Manipal Business Solutions | Offers a holistic technology-based solution using behavioral design to facilitate saving, digital financial literacy and other benefits |

| MAKSPay Fintech | Markets PehchanPe offering sachet loans, and payments and savings solutions to women micro-entrepreneurs |

| AgriPal | Community learning app leveraging radio and women ambassadors to offer financial literacy to women engaged in agriculture |

| Hardarshak | Combining the provision of social security & financial services for low-income women with a women-led agent network |

A macro-level theme coming out of presentations during the TechSprint — including a master class given by the global nonprofit Women’s World Banking — is that flawed assumptions about women’s economic empowerment can hamper the design of products to close the gender gap.

This includes the misplaced idea that women are just a segment of the consumer marketplace, when in reality they make up half of the population, with multiple nuanced and varied needs and sub-segments. Recognizing this can help government officials, product developers and financial service providers drill down into the different segments that are distinct from each other.

For example, a stay-at-home wife and mom whose husband works, a woman entrepreneur or employee, a widow, and a victim of domestic violence, may each need different product features. Similarly, the lack of financial services access for women may foster incorrect assumptions that they are less creditworthy than men, whereas data shows women generally are more reliable and trustworthy as borrowers.

Another key theme that emerged was that excluding gender considerations from product design means that financial services providers are intrinsically designing their offerings for men.

“The default position in a market dominated by men is that products will be designed for men if they’re not consciously designed for women,” said Nick Cook, AIR’s head of global strategy.

For example, men are more likely to have financial management structures based around a monthly salary, consistent with paying bills monthly. Therefore, direct debit options on most banking apps allow users to pick a day each month to set up automatic payments. But greater proportions of women work part-time, or have remuneration which fluctuates more or is paid more frequently. For them, the better question may be, “Which day of the week would you like this transaction to be executed?”

Similarly, product offerings in India tend to be suitable for consumers who already have a certain level of experience in personal financial management, and culturally that tends to be the man of the house. To close the gender gap, providers may need to adjust their offerings to cater to women and others who are relatively new to using financial products.

While the TechSprint was a competition with teams invited to participate), the Swanari event also encapsulated the supportive and collaborative nature of open-source hackathons. It was meant to foster a sense of community as all stakeholders were attempting to solve common problems.

The teams encouraged the sharing and borrowing of ideas. Product and subject matter experts were also available throughout the competition to field questions.

“The participants were generous with their knowledge and supportive of each other — far more than I have seen in my previous Techsprint experience,” said Randy Repka, director of AIR’s global TechSprint strategy. “When you are working to a goal of common good, I think people are more likely to collaborate and share ideas.”

Among the subject matter experts were representatives of the Bank of Baroda, the Indian nationalized banking company. During the I&D track, teams were able to present prototypes to a jury of expert judges for feedback.

“You try to build in opportunities for learning and direct guidance support,” said Repka.

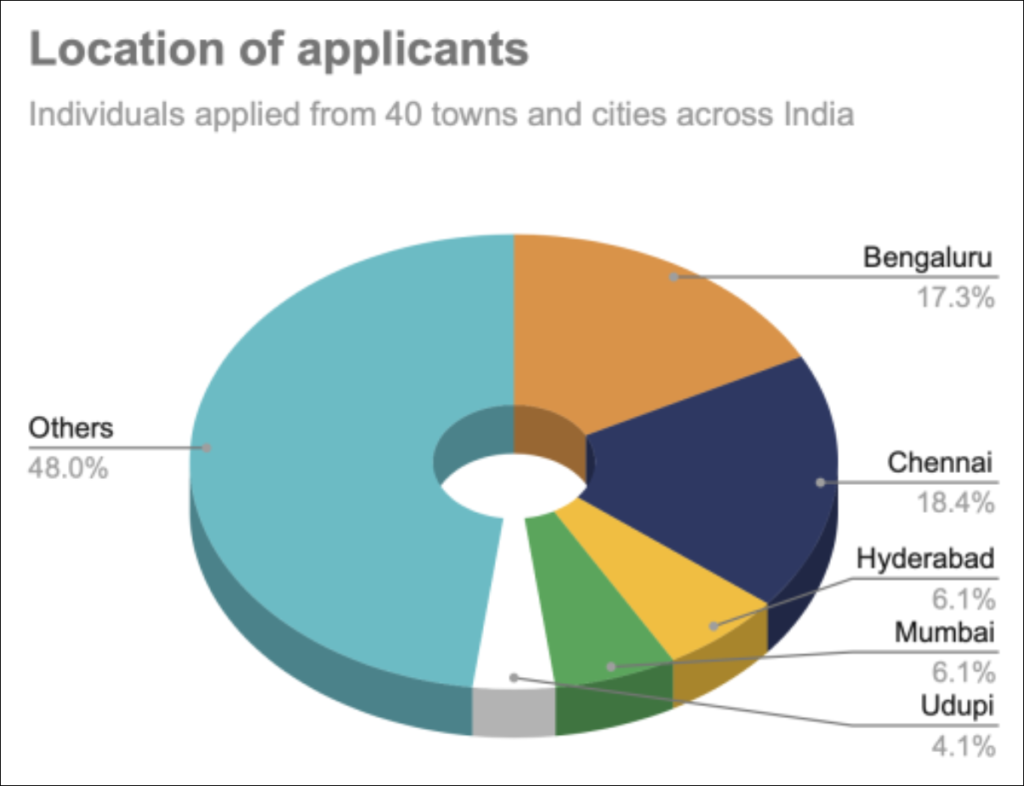

Underlining how popular the event was, RBIH received over 200 applications to join in the TechSprint’s Inspiration Community, and 1,100 total attendees joined the webinar sessions throughout the week. Applicants came from over 40 cities and towns across India. A web-based microsite established as an information resource drew more than 37,000 visitors between Feb. 28 and April 22. Web activity peaked on March 27 with over 13,000 visits.

Whereas many TechSprints produce macro-themed road maps for organizers and participants to take their ideas to the next product stage, the prototypes that won the MVP track in the Swanari competition will be able to enter an incubation process. The incubator was developed by the Centre for Innovation, Incubation & Entrepreneurship (CIIE), housed within the Indian Institute of Management Ahmedabad.

In addition to the MVP and I&D tracks, RBIH and its partners also created an “Inspiration Community” to invite other stakeholders from India and elsewhere to join speaker sessions and use the TechSprint platform to learn more about the participant teams.

The success of Swanari, meanwhile, is another key milepost in the evolution of the TechSprint concept as a collaborative platform to encourage problem-solving strategies for regulators, central banks and technology firms. It will inform how we hold future TechSprints, how TechSprints can be applied by central banks, and how we seek opportunities to help expand women’s financial inclusion and access across the globe.

Stay informed by joining our mailing list