February 26, 2024

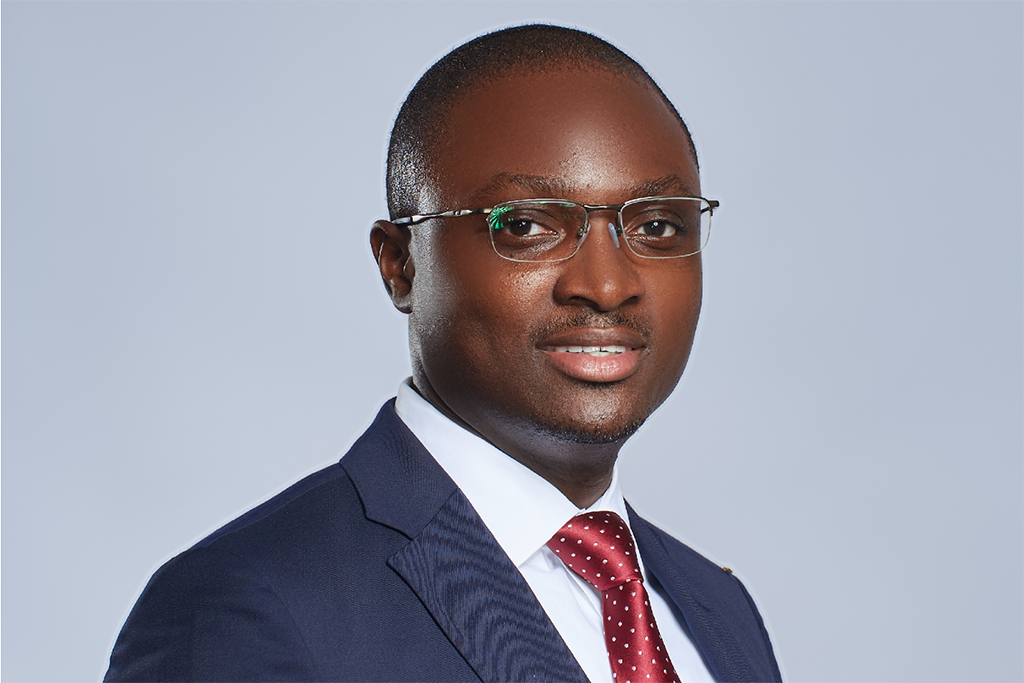

One of the joys of my job is that I get to spend time with the world’s most interesting innovators in finance, and especially in financial regulation. Today’s guest is one of the best: Kwame Oppong, the visionary and charismatic head of innovation at the Bank of Ghana.

I first met Kwame when we both spoke at the Singapore Fintech Festival in 2022. Since then, we’ve encountered each other in various parts of the world where people are gathering to figure out how to regulate the technology revolution of finance. At last fall’s Singapore festival, we found an opportunity to sit down and capture some of his insights. (Note that our surroundings there led to a slightly suboptimal sound quality, but I don’t think you’ll have any trouble following our conversation.)

The Bank of Ghana is one of the leading regulatory innovators in Africa, which in turn is a rising engine of innovation globally. Remember, mobile money was born in Kenya, in 2007, and Africa has been an early adopter of a wide range of digital financial services.

In our conversation, Kwame talks about the founding of the Bank of Ghana’s innovation unit and how they have built it out on dimensions like licensing and standards. He offers tidbits of something like a master class for regulators on how to adapt to tech transformation, and especially the cultural challenges. Kwame points out, for example, that no one who is working today on Central Bank Digital Currency was around to witness the last time societies changed the form of currency, which makes it challenging to imagine this kind of shift. He says one of the secrets to innovation is to pull people out of their silos and get them working together, both inside a central bank and between the regulators and the private sector. On the latter, for example, he shares a story of how the Bank worked creatively with Google to bar illegal money lenders from the Play Store.

AIR is working on this issue under a four-year grant from the Bill & Melinda Gates Foundation, focused on consumer financial protection in emerging markets. Digital financial services markets are, by definition, “born digital.” That fact opens up huge opportunities to oversee them with digital regulatory tools. Kwame talks about how to do this by putting better technology in the hands of both the regulator and the consumer. I was interested in his observation that the U.S. subprime mortgage crisis might have been avoided if homebuyers could have access to an AI loan shopping tool that would have alerted them to the risks – and might have been averted if regulators had had such tools in hand, as well. I believe that this kind of thinking is the future of consumer financial protection.

If you want to join in the dialogue about these changes, register for the 3iAfrica Summit in Accra, Ghana, in May.

Before we hear from Kwame, let me share two quick updates.

First, my AIR colleague Nick Cook is working on a whitepaper for regulators on how to navigate the journey to digital regulation, in terms of both technology and people and culture. For the regulators in the audience, watch for that coming out in the coming weeks.

Second, I want to add a word on the Singapore Fintech Festival. I serve on the board of Elevandi, a nonprofit organization that was founded several years ago by the Monetary Authority of Singapore. Elevandi now manages the SFF, and also the summer Point Zero Forum in Zurich, and also the newly-launching Japan Fintech Festival in Tokyo. The SFF is probably the world's largest financial conference, drawing 65,000 people in 2023. I’ve attended and spoken there almost since the beginning, and as I’ve watched the emergence of fintech conferences, it continues to strike me that this extraordinary meetup was founded, not by a conference company, but by a central bank. That means its DNA includes a sharp focus on the public policy questions raised by digital financial services. How do we assure that they are fair and safe for consumers? How do we prevent them from being abused through scams and money laundering? What’s the technological future of money, in terms of stablecoins, crypto, central bank digital currency, and AI? What’s the role of finance in addressing environmental sustainability? I encourage everyone to come to Singapore this fall and join in that global conversation.

Kwame Oppong is the Head of Fintech and Innovation at Bank of Ghana. His background spans technology, digital financial services (DFS), public policy, and regulation. He has consulted globally for governments, public sector institutions, international development organizations and private corporations. Before joining the Bank, Kwame worked with CGAP (in the World Bank Group), Millicom, HP (now HP EB) and other organizations in the banking, housing finance and health insurance industries. He is a passionate advocate for financial inclusion, innovation, and the development of digital economies.

We have exciting episodes ahead, including one with Itai Damti and Alex Acree of Unit. We also have a great show with Simone di Castri and Matt Grasser from the Cambridge Centre for Alternative Finance SupTech Lab, as well as a show with Renaud Laplanche. And we’re planning to share something special on — what else? — generative AI.

In March, my colleague Nitya Malladi will be speaking at the Women in Leadership Forum in Hayward, California. On a similar note, I will be joining a panel at the OCC for Women’s History Month (OCC only). At the end of the month I am excited to participate in EmTech’s new webinar series focused on modernizing and digitizing central banking. More information to come on that soon.

In May my colleagues Shelley Anderson and Grace Mathebula will attend the 3i Africa Summit in Accra, Ghana.

If you enjoy Barefoot Innovation, it’s important to take a moment to leave us a five-star rating on your favorite podcast platform to help us reach more people. Also please find me on social media to continue the conversation.

Stay informed by joining our mailing list