June 04, 2021

What stands in the way of financial health? That’s a complex, multi-dimensional question, but one whole dimension is the design of the financial system, which has obstacles woven into every inch of its fabric. Financial products, industry cost structures, delivery channels, traditional pricing and profit models, traditional risk tools, disclosures and information content, the system’s infrastructure, such as the process for clearing payments -- all of these evolved together over centuries into a system that is expensive and rigid. In many respects, the system works very well. For optimizing financial opportunities for people with limited income, wealth, mobility and credentials, however, it doesn’t. It may have been the best we could do with 20th century technology, but it’s not the best we can do today.

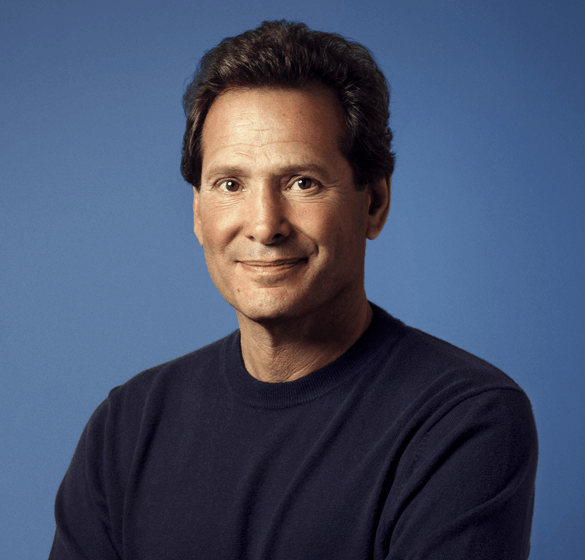

No CEO of a major financial company has thought as deeply about this challenge as today’s guest, PayPal’s Dan Schulman. More than anyone I can think of, Dan has been speaking on these themes for years and calling on us all to find innovations that can help.

Today, he seems optimistic -- or at least determined. As nearly all our guests are doing, he points to the year of COVID as a turning point, both in breaking through to rapid new technology adoption and in galvanizing a real will to do better following the killing of George Floyd. Dan sees progress ahead.

We need it. In our talk, he lays out the status quo and the reality that today, it’s expensive to be poor. He talks about the stubbornness of the racial wealth gap -- THE same today as it was in the 1960s. He describes the economic fragility of the new middle class. He talks about how our slow ways of moving money harm the poor. And he ties these struggles to today’s civic upheaval -- he says democracy relies on people believing in the system, and that it’s hard to believe, when people struggle every day just to do the basic things of life.

What can be done? Part of it is investment. PayPal made a $535 million commitment last year across multiple areas to address the racial wealth gap, and Dan gives an update on those efforts. He also talks about how to bolster America’s small businesses, which are a key driver of economic well being. PayPal is one of the top five providers of small business working capital, and they do it without relying on credit scores. Dan shares eye-opening numbers about how the impact of this work, with 70% of the working capital going to the 10% of US counties where ten or more banks have closed branches. These are disproportionately low income neighborhoods and businesses that are minority- and women-owned. The impact is that average sales rise by 21%, compared to a control group with 1%. In other words, these are businesses that can grow, if only they can get the capital they need. In the pre-digital financial system, they get starved for credit. New technology can fix that.

Dan also talks about modernizing the payment infrastructure to eliminate the unnecessary costs it imposes and to help assure that no one is left behind. I of course ask him about PayPal’s big step this year in introducing a cryptocurrency wallet (which is part of the huge story that 2021 is the year of crypto going mainstream). Dan talks about how crypto will reshape the financial system - he says the form factors will change -- and that these new rails will make the system more efficient, less costly, and more inclusive, and will increase utility at the same time.

We also talk about the challenges ahead, which are huge -- security, privacy, bias, and the need for the financial system always to be worthy of trust. He has thoughts for policymakers as they grapple with getting all this right as things move so fast, and as COVID “catapults” us forward in using new technology.

Finally, Dan believes that building a new, better economy will require what he calls responsible leadership. He’s a fan of capitalism, but thinks it needs a serious upgrade - too many people are disenfranchised. He tells about doing a study inside PayPal -- which pays well in every market they operate in -- and discovering that a large share of their entry level workforce were struggling just to make ends meet. It was an epiphany for Dan, in realizing that the market isn’t working for a lot of people. He talks about the steps that PayPal has taken in response, and more broadly about how he thinks market capitalism must evolve into new models -- to be accountable to more stakeholders, and to incorporate focus on medium and long term impact, not just quarterly performance. Profit and purpose, he says, are not at odds with each other. They are, increasingly, aligned.

Dan thinks the financial sector today has a moon shot opportunity. If the industry and government seize this moment, we can create a new marketplace. He says the solutions are within our grasp, and that it would be a shame if we don’t -- grasp THEM.

Enjoy...

More on Dan

Dan Schulman is CEO of Paypal. With extensive corporate experience and a lifelong commitment to social justice, Dan Schulman believes the private sector has a responsibility to serve multiple stakeholders and to improve the state of the world. Dan has frequently been recognized by Fortune as one of the top 20 Businesspersons of the Year and has received “Visionary Awards” from the Council for Economic Education and the Financial Health Network in 2018 for his promotion of economic and financial literacy to create a better informed society. In 2020, Robert F. Kennedy Human Rights honored him with the Ripple of Hope Award, which recognizes those who have demonstrated a commitment to social change and a passion for equality, justice and basic human rights. Dan is committed to building a world where everyone has access to economic opportunity, which he advances through his work as a life member of the Council on Foreign Relations and co-chair of the World Economic Forum’s Steering Committee to promote global financial inclusion.

More for our Listeners

Please follow AIR on LinkedIn and Twitter, and also follow me personally on Twitter @JoAnnBarefoot. And be sure to leave us a five-star rating on your favorite podcast platform.

On June 14, we are partnering with Google to host a webinar called AI and Financial Regulation: Exploring Benefits and Managing Risks. Artificial intelligence and machine learning are transforming how financial companies operate, including how they manage regulatory compliance. I’ll have a keynote fireside chat there with Congressman Bill Foster and Congressman Anthony Gonzalez, who are the Democrat and Republican leaders of the newly reappointed House Financial Services Committee Task Force on Artificial Intelligence. We’ll also hear from AI experts at Google and other organizations. We will especially look at the AI-related innovations that are developing as a result of the new Anti-Money Laundering Act, which is the biggest BSA/AML overhaul in the US since the Patriot Act. I also know many of you are hard at work writing comment letters for the joint RFI on AI that was issued by the US banking agencies (which, take note, has extended the deadline for comments to July 1). Our webinar will offer ideas on these cutting-edge issues. Register here.

If you’re in the crypto world in any way, take a look at our Crypto Climate Accord.

Next up on Barefoot Innovation we have Sultan Meghji, the new Chief Innovation Officer of the FDIC who, as you will see, has a technology background and a bold vision for the future of financial regulation. We will also have former OCC Chief Counsel Amy Friend, who has authored AIR’s most recent paper, The Financial Conduct Authority’s Innovation Journey: Moving Forward in the Face of Uncertainty. Other shows will include conversations with the Deputy Governor of Central Bank of Kenya, Sheila M’Mbijjewe, who I had the pleasure of speaking with during our Women’s Economic Empowerment Conference.

June is another busy conference month! I will be speaking at the Singapore RegPac RegTech Summit, Fintech South, FinCrime World Forum, and the India Economic Times BFSI Tech Leaders’ Summit. I’ll also give a keynote talk on regtech for the ABA’s Regulatory Compliance Conference — the one and only RCC. My colleague David Ehrich and I, meanwhile, are also speaking at numerous events hosted by and for regulators, and hope to see many of you in those fascinating conversations.

Stay informed by joining our mailing list