BLOG • Tackling Digital Payment Fraud: Lessons from West Africa’s TechSprint

AIR is dedicated to playing its part in the global fight against fraud, including the growing challenge of digital payment fraud. Read takeaways from our recent TechSprint.

TECHSPRINT • TechSprint to Combat Digital Payment Fraud in West Africa

The Alliance for Innovative Regulation (AIR) hosted a virtual TechSprint focused on detecting and combating digital payment fraud in West Africa.

BLOG • Power of empowerment: Swanari TechSprint Takeaways

AIR was a partner with India’s Reserve Bank Innovation Hub on a tech competition and ideas forum exploring digital financial services solutions for women’s economic advancement.

PODCAST • The Mojaloop Foundation’s Drive for an Interoperable Financial System

The foundation’s leaders, Paula Hunter and Lesley-Ann Vaughan, speak with Jo Ann about their work to expand financial inclusion through open-source software with interoperability as a central component. The word mojaloop means “one” in Swahili.

PODCAST • Kenya Is Proof of How Emerging Markets Can Lead on Regulatory Innovation

Jo Ann speaks with Sheila M’Mbijjewe, deputy governor of the Kenya Central Bank, about the African country’s leadership in mobile-payments development and adoption. Half of the nation’s GDP has moved onto the M-Pesa rails.

PODCAST • How to Include Everyone: The Gates Foundation’s Michael Wiegand

Michael talks about the global evolution of financial inclusion and the Bill & Melinda Gates Foundation’s ongoing efforts. Learn about digital financial inclusion, consumer protection, digital public infrastructure, and barriers to fair finance.

PODCAST • The Bold Vision of Singapore Central Bank Chief Ravi Menon

Ravi Menon, the managing director of the Monetary Authority of Singapore, has charted a bold course on regulatory innovation, inventing new models that are being emulated throughout the world.

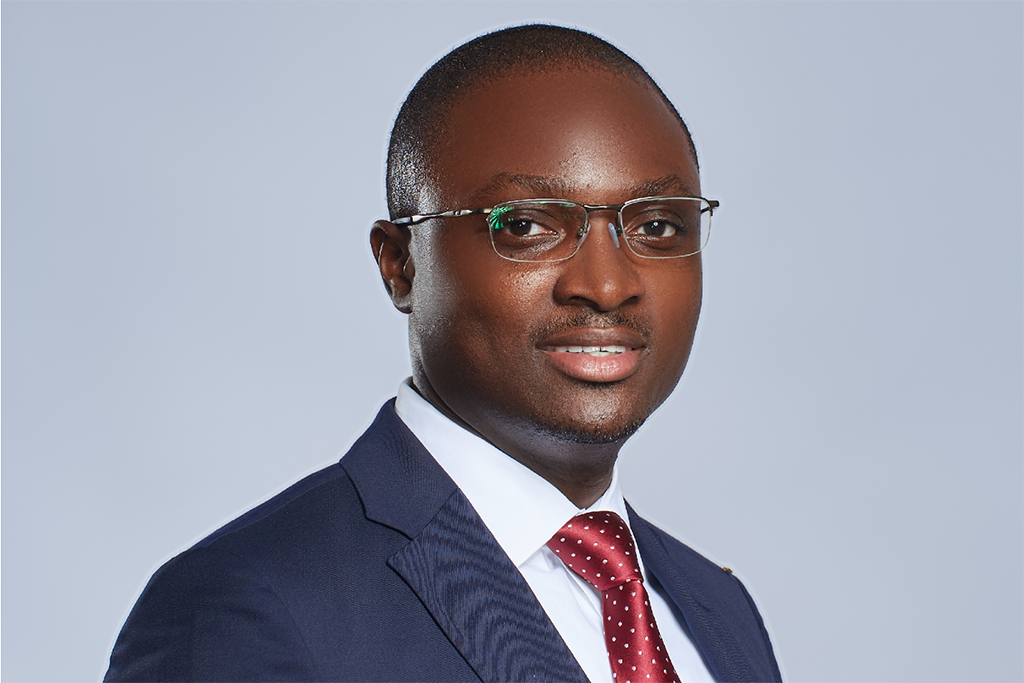

PODCAST • Innovation in Africa: Bank of Ghana’s Kwame Oppong

Kwame is the charismatic head of innovation at the Bank of Ghana. He shares advice for regulators on how to adapt to tech transformation and emphasizes collaboration to break down silos and foster innovation.

PODCAST • Barefoot Innovation Podcast Hits 200-Episode Milestone

It has been quite a ride since our first episode in 2015. Over more than eight years, this show helped mark AIR’s founding, unpacked what the pandemic and other events meant for financial regulation, and hosted so many enlightening discussions about disruptive technology.

PODCAST • Castles and Sandboxes: The Gates Foundation’s Kosta Peric

Jo Ann’s guest is Kosta Peric, the Bill and Melinda Gates Foundation’s Deputy Director of Financial Services for the Poor. In this episode, he discusses the uniquely difficult problem-solving needed to achieve full financial inclusion.

TECHSPRINT • AIR, U.K. Regulator Team Up on Women’s Empowerment TechSprint

The Alliance for Innovative Regulation and Financial Conduct Authority partnered on a transatlantic competition and conference examining ways to address the disproportionate impact of the COVID pandemic on women.

PODCAST • The Reserve Bank of India’s Path to Financial Inclusion

Rajesh Bansal is head of India’s Reserve Bank Innovation Hub, which along with AIR hosted the Swanari TechSprint looking at ways to expand financial services access for women. He speaks with Jo Ann about the country’s pioneering innovation strategy.

Stay informed by joining our mailing list