INITIATIVE • NextGenAI Explores the Future of Financial Oversight and Consumer Protection

NextGenAI is a multi-faceted initiative that delves into the potential impact of Generative AI (GenAI) on financial services and financial regulation through a series of thought-provoking and engaging activities.

PODCAST • Fully Fair Lending: NFHA CEO Lisa Rice

Discrimination in the credit markets is a persistent problem. Lisa Rice, head of the National Fair Housing Alliance, says we can solve it if we understand the role of structured, hidden bias, and use new technology to root it out.

PODCAST • How Delicia Reynolds Hand Works to Empower Fintech Consumers

Hand, the Director of Financial Fairness Advocacy at Consumer Reports, leads the magazine’s initiative to evaluate new fintech products to give customers greater awareness of the rapidly changing financial services market. The ratings system could be a game-changer for pricing and product development.

PODCAST • How Minority-Backed Institutions Can Stay Competitive in Digital Age

In this special episode, Jo Ann speaks with three innovators working to help Minority Depository Institutions modernize their technology to continue serving communities of color.

PODCAST • How to Include Everyone: The Gates Foundation’s Michael Wiegand

Michael talks about the global evolution of financial inclusion and the Bill & Melinda Gates Foundation’s ongoing efforts. Learn about digital financial inclusion, consumer protection, digital public infrastructure, and barriers to fair finance.

PODCAST • Innovation in Africa: Bank of Ghana’s Kwame Oppong

Kwame is the charismatic head of innovation at the Bank of Ghana. He shares advice for regulators on how to adapt to tech transformation and emphasizes collaboration to break down silos and foster innovation.

PODCAST • Jason Cave on FHFA’s Goal to Modernize Mortgage Process With New Tech

Following the Federal Housing Finance Agency’s Velocity TechSprint, the official leading the agency’s conservatorship and fintech strategies joins Jo Ann to discuss all the ways the mortgage market is ripe for a technology overhaul.

VIDEO • NextGenAI: The Future of Financial Oversight and Protection

Through the NextGenAI initiative, AIR aims to investigate the potential of GenAI to foster efficient and effective consumer protection, enable enhanced regulatory compliance within financial institutions, and support cost-efficient, timely and more effective regulatory supervision.

PODCAST • The Reserve Bank of India’s Path to Financial Inclusion

Rajesh Bansal is head of India’s Reserve Bank Innovation Hub, which along with AIR hosted the Swanari TechSprint looking at ways to expand financial services access for women. He speaks with Jo Ann about the country’s pioneering innovation strategy.

PODCAST • Machines that Read Regulations: FINRA’s Goal Could Soon Be Reality

In this episode, Jo Ann speaks with innovation leaders at the Financial Industry Regulatory Authority, Haimera Workie and Alex Khachaturian, about a new tool to help transform financial regulation and compliance.

WHITE PAPER • Harvard Papers on Financial Inclusion

Fifty years of U.S. regulation aimed at promoting financial inclusion and consumer fairness has largely failed. In these papers, AIR CEO Jo Ann Barefoot reports on her two years as a Harvard senior fellow, arguing that new technology can lead to better results.

PODCAST • Demystifying DeFi and Web3 with Tomicah Tillemann

Tillemann, Chief Policy Officer of Haun Ventures, shares his views about the crypto winter and how the confluence of blockchain, open source and digital tokens could solve stubborn problems.

EVENT • Hot Topics in Digital Consumer Financial Protection

Is innovation good or bad for consumers? AIR partnered with Consumer Reports and Consumer Federation of America on a virtual event about consumer implications of data permissioning, cryptocurrencies and new forms of lending, among other things.

NEWS • AIR and Cambridge SupTech Lab Announce Virtual Hackathon Exploring Consumer Protection Innovations

The joint event will identify how financial supervisors can optimize complaint data received through chatbots and other channels to effectively protect and empower consumers.

PODCAST • Activism and Algorithms: Making Lending Fairer

Lisa Rice, CEO of the National Fair Housing Alliance, is a civil rights activist. Kareem Saleh is a tech guy who founded the startup FairPlay, which uses AI analytics. They come from different worlds, but have teamed up to combat unfair lending.

PODCAST • How Credit Unions Cut an Innovation Path: NCUA Chair Todd Harper

Todd Harper is the first head of the National Credit Union Administration appointed after serving in the agency’s own ranks. His conversation with Jo Ann touches on the NCUA’s new innovation office, and the technology pressures and opportunities facing credit unions.

PODCAST • Delicia Hand, Cleve Mesidor on Rethinking Consumer Protection Paradigm

The question of how to expand access and ensure fairness for people of color deals with finding the right balance of regulation, technology and traditional finance. Two leaders on this issue speak with Jo Ann about finding the best answers.

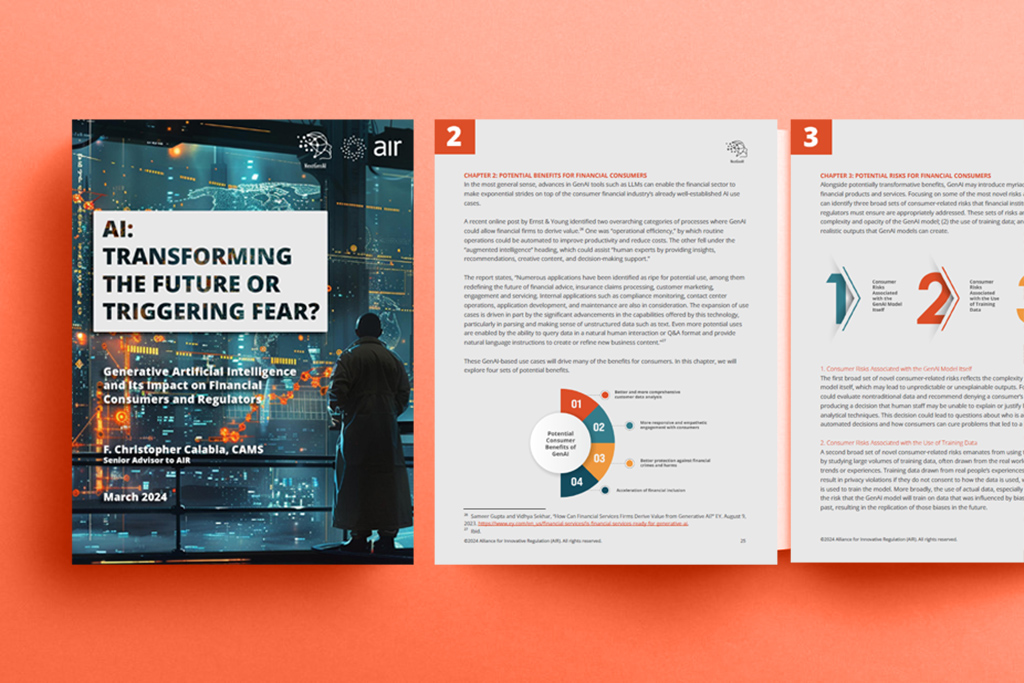

WHITE PAPER • AI: Transforming the Future or Triggering Fear?

Authored by AIR Senior Advisor and former global regulator F. Christopher Calabia, this paper examines the transformative potential and risks associated with the deployment of generative artificial intelligence (GenAI) in the financial services sector.

Stay informed by joining our mailing list